Our Wealth Management Process is Truly Holistic and Independent.

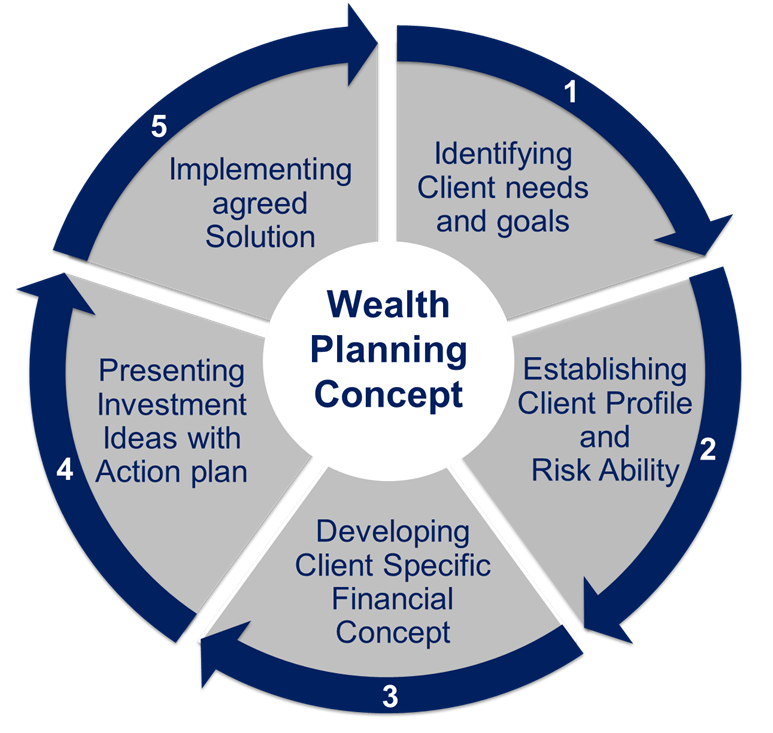

Within our Discretionary asset management mandate, we utilises a specifically devised five step process model, in order to analyse and understand your financial circumstances, your immediate needs and your future goals.

We then superimpose our risk frame-work upon your chosen strategy and match your risk tolerance and ability to your portfolio.

The resulting ideas are discussed and finalised in a specific financial concept, alongside the investment ideas and the action plans. Subsequently, our research team begins with the allocation of assets within your portfolio with a long-term growth perspective in mind.

True Independence means no bound to any financial institute or bank facilitating the sale of their products. The final choice of the assets lies by our execution desk and your preferences uttered in our discussions.

Mandates are monitored constantly in view of the market events and correctly re-positioned when necessary. In pursuit of this, we utilise the research departments of our partner banks and other financial institutions as well as the portfolio management and trading expertise of our asset management division.